Questions and Answers on South African Companies Act

New 3rd Edition incl King IV applications

R

745.00

( R647.83 Excl VAT )

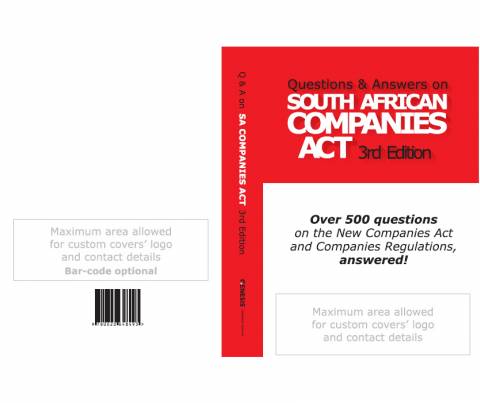

Cover

- Plain cover

- Your cover

Bulk Discounts

- Save R 100.00! R 645.00 (R 560.87 Excl VAT) unit cost, on quantity 10 or more

Shipping

- 20% of unit cost Courier: 20% of unit cost, with quantity 1 or more

- R 0.00 per unit Collection: R 0.00 per unit, for quantity 1 or more

New 3rd Edition

Third Edition includes Practical Answers and Explanations to a selection of over 500 Questions around the new South African Companies Act and Companies Regulations including Q & As around the new King IV ™ Corporate Governance Reporting!

SOME SELECTED QUESTIONS FROM THE BOOK

- What is a reportable irregularity?

- How is capital maintenance handled under the Companies Act 2008?

- Who may call a shareholders' meeting?

- What are the types of special resolutions under the new Companies Act?

- What is the difference between a statutory audit and a voluntary audit?

- What is the difference between an audit and an independent review?

- What are the instances when a company must apply the solvency and liquidity test?

- May a public company be converted to a private company?

- May a non-profit company be converted to a profit company?

- May a non-profit company amalgamate or merge with a profit company?

- May a profit company be converted to a non-profit company?

- May a trust be a director of a company?

- May a trust be a beneficiary of another trust?

- Who are legally bound by a company's Memorandum of Incorporation and rules?

- May a partnership or juristic person be appointed as a company secretary?

- What are the statutory liabilities of a company secretary?

- May a company secretary sign a board resolution?

- How is the interest of minority shareholders protected?

- When must a private company have an AGM?

- How many members should a board consist of and how do you determine that number?

- What is the difference between a director and prescribed officer under the new Companies Act?

- Is there a difference in law between the duties and liabilities of executive directors and non-executive directors?

- Under what circumstances is an owner-managed company's annual financial statements subject to an audit?

- Who can serve as a director of a non-profit company and what will be expected of them?

- What are the defences for a director?

- Under what circumstances is a close corporation's annual financial statements subject to an audit?

- Should independent reviewers be rotated similar to auditors?

- What is the going concern test in relation to the Companies Act and the new International Auditing Standards rules?

- Why should a company customise its Memorandum of Incorporation (MOI)?

- What provisions should be contained in a shareholders agreement?

- Who has access to company records?

- What is the risk embedded in share options as a form of remuneration for non-executive directors?

- May a close corporation or a trust be a subsidiary of a holding company?

- What are the fundamental elements that needs to be included in an MOI?

- Are the incorporators of a company regarded as its first directors?

- What is a ring-fenced company?

- When does an amendment to a company's MOI become effective?

- What is the difference between technical solvency and commercial solvency?

- What constitutes reckless trading?

- Who may sign a share certificate if a company has only one director?

- To whom must the company give written notice in the event of granting financial assistance to one or more of its directors?

- Who should be an independent, non-executive director?

- When does a person cease to be a director of a company?

- How does the solvency and liquidity test in relation to distributions differ from the general application of the solvency and liquidity test?

- What are the director's duties relating to a conflict of interest?

- What are the new requirements of the New Auditor's Report in relation to the going concern?

- What are the changes regarding meetings and notices under the new Companies Act?

- What are the avenues that may be explored in the removal of a director of a company?

- What are the grounds to declare a person ineligible to serve as a company secretary?

- What are the grounds to declare a person disqualified to serve as a director of a company?

- What are the grounds to declare a person to be disqualified to serve as a prescribed officer?

- What are the grounds to declare a person to be ineligible to serve as a director of a company?

- What information must be maintained in the records of a company’s past directors?

- Who may apply to declare a director or a prescribed officer delinquent and under what circumstances must a director or prescribed officer be declared delinquent?

- How does the solvency and liquidity test in relation to distributions differ from the general application of the solvency and liquidity test?

- What are the director's duties relating to a conflict of interest?

- What are the new requirements of the New Auditor's Report in relation to the going concern?

- What are the changes regarding meetings and notices under the new Companies Act?

- May an existing accountant retain documents of a client who has not paid the fees owing to him?

- In the event that permission is requested to communicate with an existing accountant by a subsequent accountant who has been approached to replace the existing accountant and permission is refused or not granted by the client, may the subsequent accountant accept the appointment of accountant for the client?

- May an accountant delegate his authority to sign the financial statements of his client to his trainee accountant?

- When does the obligation to report a reportable irregularity arise?

- In line with the ‘enlightened shareholder approach’ of the Companies Act, the Act gives other stakeholders, e.g. employees, certain rights and remedies. The 2008 Companies Act has introduced seven new remedies. What are they?

- How are alternative dispute resolutions handled in terms of the Companies Act?

- Who facilitates alternative dispute resolutions and reviews decisions of the CIPC?

- What is an “offer period”?

- What is a “regulated company”?

- What is the prescribed percentage of the issued voting securities of a company?

- When is a transaction exempt from the obligation to make a mandatory offer following the publication by a regulated company of a transaction requiring a cash subscription?

- Are comparable offers required for options?

- What does a “partial offer percentage” mean?

- Under what circumstances is a partial offer exempt from compliance with chapter 5 of the Companies Act and chapter 4 of the Regulations?

- What is the timeline of an offer?

- May an offer be extended?

- May an offer be revised?

- May a person withdraw acceptance of an offer and subsequently re-accept a particular offer more than once at any time?

- Does an acquisition mean the acquiring of securities of a company as a result of the acquisition?

- If the holding company is an external company and has entered into a proposed transaction to dispose of all or the greater part of the assets or undertaking of its subsidiary, which shareholders must approve the transaction – the shareholders of the holding company or the shareholders of the subsidiary?

- What does “act in concert” mean?

- Is the expropriation of the shares of minority shareholders in one or more companies which are party to an amalgamation or merger, prohibited or allowed?

- What are the criteria that a company must meet if the prospectus contains a minimum subscription?

- What are the restrictions on an allotment of a company’s securities?

- What is the minimum interval before any allotment of securities or the acceptance of an offer in terms of a company’s securities may be made in the pursuance of a prospectus?

- On what grounds will a rights offer be exempted from the requirements of chapter 4 of the Companies Act?

- What is the percentage threshold for the consent of members in a close corporation in the event that the close corporation disposes of immovable property owned by the close corporation?

- What are the seven statutory reasons where members of a close corporation are jointly and severally liable for the specified debts of that corporation?

- What are examples of company rules?

- What is the legal status of company rules?

- When must the rules of a company be filed with the Commission after being published, ratified, rejected or amended, altered or repealed?

- Is the conversion of shares into debt instruments regarded as a distribution?

- What is a dividends tax?

- How may a company issue authorised shares to the shareholders as capitalisation shares?

- Who are legally bound by a company’s Memorandum of Incorporation and rules?

- Does the failure of a company to ratify its rules affect the validity of any decisions taken in terms of those rules during the period that they had an interim effect?

- What is a special purpose vehicle (SPV) company?

- What are the compliance requirements for a public company?

- What are the compliance requirements for a state-owned company?

- What are the compliance requirements for a private company in public interest?

- What are the compliance requirements for a private company?

- What are the compliance requirements for an owner-managed private company?

- What are the compliance requirements for a personal liability company?

- What are the compliance requirements for a non-profit company?

Specifications

| Over 500 Questions and Answers | |

| 3rd Edition | |

| A5 Size | |

| ~ 550 Pages |